What Is an Equipment Leasing Agreement?

Acquiring equipment is expensive. Whether you are looking for a new forklift or an MRI machine, most equipment purchases can set a business back months of revenue. Any equipment acquisition must be considered very carefully, with every step of the process often requiring proper oversight from the highest authority in the company. An equipment leasing agreement can be a good and cheaper solution for any business to acquire equipment.

With the rate at which technology develops nowadays, seeking financing for a new piece of equipment is even more stressful than before. A brand-new plastic mixer for your industrial manufacturing process might be outdated in less than ten years. Medical equipment is advancing at an even faster pace. And in some industries, like sports, fitness, and medical rehabilitation, you may be looking at replacing or upgrading specific equipment as often as once a year.

Whenever you foresee an equipment purchase that might result in an upgrade in just a few short fiscal calendar years, it is often wiser to lease your equipment instead. An equipment leasing agreement can save you the trouble of reselling and reacquiring equipment later down the line, saves you the stress of negotiating a loan with a bank, and saves your precious working capital from having to face a potential down payment or an outright day-one acquisition.

What Is Equipment Leasing?

Equipment leasing is functionally equipment renting – your business pens and signs an agreement with a vendor, lender, bank, or other financial institution, authorizing the use of specific equipment and maintenance perks in exchange for monthly payments made over the course of a set term.

At the end of the term, the lease ends – and the equipment returns to the owner’s warehouse. Some equipment leasing agreements are written with the implication that the end of the term leads to the acquisition of new equipment – the lease may be renegotiated, and then the old equipment is swapped out for the newer model.

Other leasing agreements are also written with an option to buy total ownership over the leased equipment for a nominal value, or the rest of the equipment’s total worth, depending on the length of the lease term and the value of each monthly installment relative to the total cost of the equipment.

The Benefits of an Equipment Leasing Agreement

Equipment leasing agreements are often a superior option versus outright purchasing new equipment because it allows a business to benefit from the use of equipment it would otherwise be unable to afford without nearly the same impact on a business’ on-hand working capital.

Furthermore, an equipment leasing agreement usually does not require a down payment or at least does not require a significant down payment. If you decide to seek financing for your new equipment instead, you may be asked to pay 10-20 percent upfront, which your business might not be able to shoulder.

This helps you preserve your company’s cash flow, which is crucial to maintaining a steady growth rate, enabling the expansion, and keeping your finances under control to qualify for other term loans on costs you may not be able to get alternative financing for.

Leases are also set to expire at the end of their term, meaning you can cycle to a newer model at the end of each lease, keeping up with new standards and the cutting edge of your industry. This saves you the trouble and cost of seeking a valuation and the services of a broker to facilitate the resale of your old equipment for a new purchase. Finally, leasing equipment affords you a substantial tax benefit in tax deductions equal to each lease payment (classified as a business expense).

Types of Equipment Leases

There are multiple different types of equipment leasing agreements, but most can be categorized as either capital leases or operating leases.

Capital Leases

Capital leases are equipment leases on equipment a business aims to own at the end of the lease term but cannot outright purchase. This is a good option for equipment that you cannot otherwise finance yet is worth owning due to its longevity or the fact that it can appreciate as an asset to the business. In a typical capital lease agreement, the lessee (person applying for the lease) must cover maintenance, insurance, and tax costs on the leasing equipment.

Operational Leases

Operational leases are, as the term implies, a basic rental agreement. The costs of maintaining and fixing the equipment are all-inclusive in the monthly lease payment, and these leases tend to be shorter-term and cancelable, in contrast to long-term capital leases where the plan is to end up becoming the complete owner, with the equipment itself acting as security for the lease agreement. There is usually no penalty for terminating an operational lease if the equipment hasn’t been damaged.

Creating an Equipment Leasing Agreement

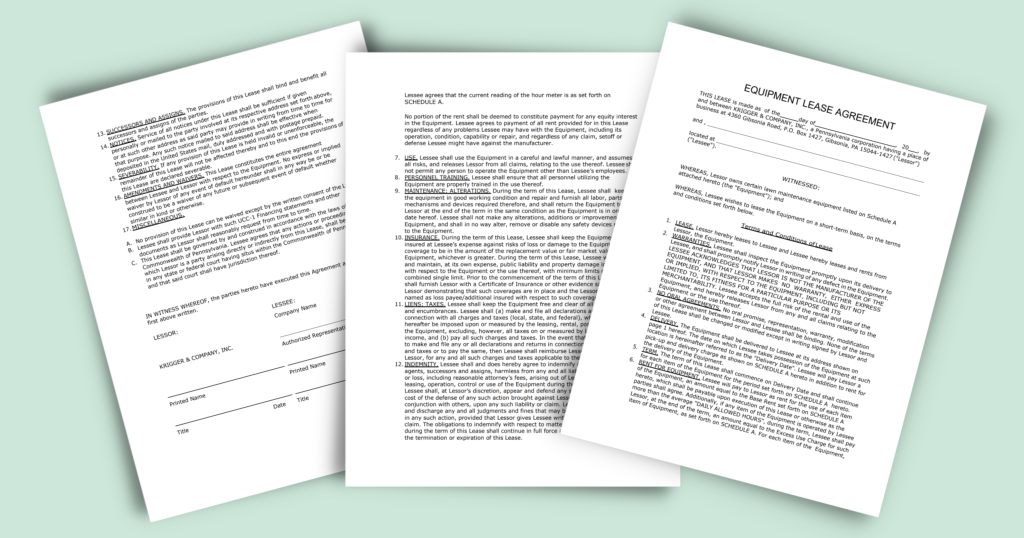

Equipment leasing agreements are contracts between at least two different parties – the lessee and the lessor. Some details that must be made clear in an equipment leasing agreement include:

- The lease duration.

- The financial terms of the agreement (payment deadlines, penalties for missed payments, etc.).

- The exact value of the equipment.

- Tax responsibilities.

- Maintenance and insurance responsibilities.

- Cancellation terms.

- Lease purchase options.

- Lease renewal options.

Who Provides Equipment Leasing Agreements?

Equipment leasing agreements come from different sources, but most of the time, you will want to look for financial institutions specializing in lending and the vendors with which you already have an established relationship. One of the benefits of a lease agreement is that if you establish it with a lender or vendor you work with regularly, then providing on-time payments and establishing a history of reliability as a lessee may net you better terms and agreements in the future.

Equipment Leases vs. Loans

As a rule of thumb, try to own anything that appreciates in value and lease anything that depreciates in value. This is a simplified rule, of course, and the best course of action will depend heavily on your given industry, the value equipment might bring versus its initial cost, the equipment’s useful life, maintenance costs, other minute circumstances, and the tax considerations of a purchase versus a lease agreement.