What To Look for In Equipment Leasing Companies

Equipment leasing has the potential to save you a large amount of money. Here are some things you might want to consider when looking for equipment leasing companies.

Lean growth is the name of the game. Managing your costs effectively and reinvesting your profits wisely is important to survive against today’s stiff competition, regardless of the industry you’re operating in. Yet, there are things no business should cut corners on, including the quality of their equipment.

However, a new piece of equipment can be a hefty investment. Not every business has the cash lying around to replace what they’re working with right now. Buying new equipment not only puts a massive dent in your capital but also leaves you with outdated equipment in a few years. For many types of equipment, it pays to lease it instead.

By carefully considering your equipment leasing options, you can preserve your cash flow and keep your working capital for a rainy day. But then the big question becomes: who do you lease from? Equipment leasing companies exist for nearly any commercial asset, from phones and computer desks to forklifts, CNC machines, cement mixers, and trucks.

Finding the right one to work with is about more than just finding the equipment you need in their inventory. There are hidden costs to consider, maintenance fees to look out for, and other contractual details that you might come to regret in time. Here’s what you might want to consider when looking for equipment leasing companies to work with.

Equipment Leasing Companies – How Can They Help?

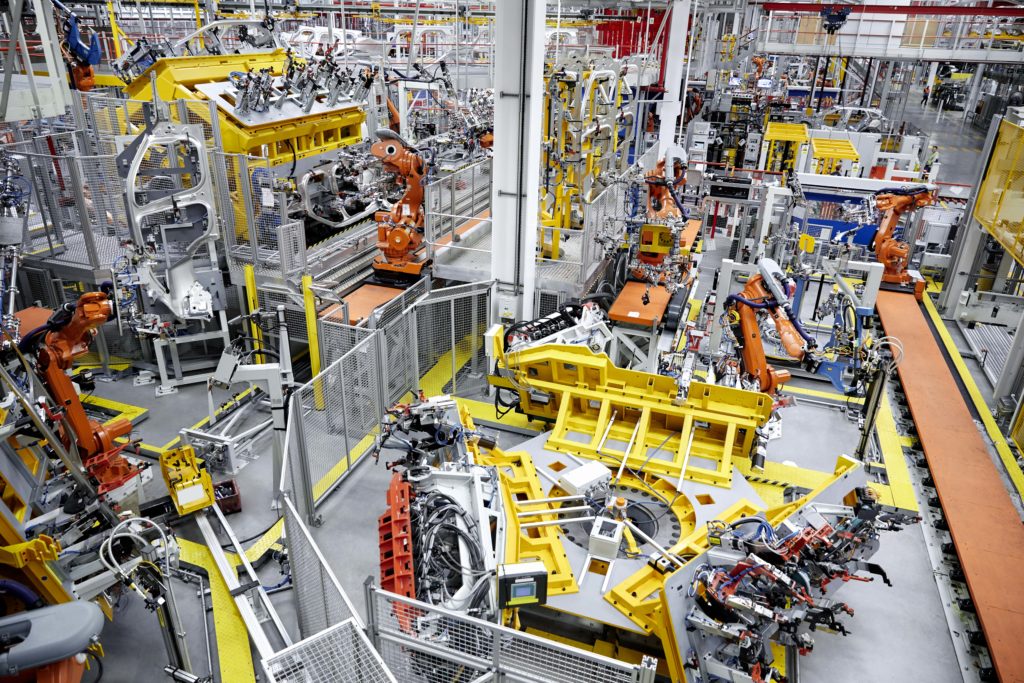

Equipment leasing is popular across all industries. A brand-new manufacturing plant without the millions needed in capital to furnish itself from scratch will need to consider equipment leasing for several expensive and specialized pieces of machinery.

Construction companies that provide services across multiple different types of construction are best served leasing the equipment they need for a large job versus buying it outright and sitting on equipment they won’t use for the majority of its useful lifetime.

Even larger enterprises with the capital needed to buy equipment outright will consider leasing as a way to preserve capital and invest it elsewhere. Other financing options, like a bank loan, may be harder to come by than an equipment lease and are best used to bolster cash flow in a bad season.

Equipment leases are simple. A vendor or financial institution will either provide the equipment or pay for its purchase and remain in ownership of it as lessor while providing the lessee with the right to use it during the term of the lease. The conditions of the lease are ratified through a signed lease document, and the lessee becomes obligated to make monthly payments or lump sum payments as per the conditions of the lease until the term is ended.

It’s within the formulation of the lease document that things begin to take shape, and the differences between different companies and leases become apparent.

Location and Delivery

First things first – where are your prospective equipment leasing companies located? And what do they charge to bring their equipment to you?

Delivery costs for certain equipment can be immense, especially if we’re talking about something as heavy or fragile and calibrated as laboratory equipment, advanced 3D printers, industrial CNC machines, commercial freezers, forklifts, and so on. The distance between you and the leasing company can have a serious impact on the initial cost of the transaction.

Determine Your Budget and Equipment Goals

The next consideration is simple: what can you afford? Any business will have a definitive budget for any given piece of equipment based on their current and projected revenue, and what they expect to be earning through that equipment. Be conservative and realistic. This can help narrow down your choices and bring you down to a shortlist of vendors.

Conditions of Return

What’s really understood as wear-and-tear? To what degree can equipment be “pre-loved” before the leasing company refuses to take it back and requires you to buy it outright? Is there any insurance on the equipment lease, and what kind? What should you financially prepare yourself for if things go wrong, and can you afford to carry that kind of risk?

When you’re working with equipment leasing companies, it’s important to continuously remind yourself that you never own the equipment. You are simply paying for the right to use the equipment temporarily, but you are effectively saddled with the responsibility of caring for and managing machinery or equipment that does not belong to you. This can lead to grave financial consequences if something goes wrong or is left unaccounted for.

Maintenance Costs and Agreement

Assuming nothing goes wrong, leased equipment must still be regularly maintained to achieve maximum longevity and ensure that it operates at peak efficiency. Some leases leave maintenance costs up to your discretion, while other leases take those costs upon themselves.

Others yet are more restrictive, requiring you to pay for maintenance and directing you to the specific repair and maintenance company, you must go to. This can end up costing you significantly more than if you had the choice to work with the maintenance company you usually work with, for example.

Long-term Vendor Relationships

Another factor that may impact your decision-making when choosing equipment leasing companies to work with is your prior experiences with equipment leasing. If you’ve had great experiences with a vendor in the past, chances are they’re high up on your list of choices for similar equipment. Don’t be afraid to shop around. It’s your responsibility to make the best possible choice for your company.

What to Expect When Leasing Equipment

Some equipment can’t be easily leased. You may have a difficult time finding equipment to lease with a total value of less than $5,000, for example. In this case, you could be better off taking a line of credit or a loan to buy the equipment, especially if you are a new business with capital stretched thin as it is.

It’s also important to note that if you have an established relationship with a lessor or vendor, you can bundle leases into a master lease to keep track of payments and terms and continuously update and amend a single document rather than appending a hundred new exhibits over the years.

Last but not least, always review lease documents and terms with a legal professional. These are contracts, which can stipulate precisely when and how the equipment is to be used, the conditions of return, the severability of the lease, and many other sections. Reviewing them carefully can save you a lot of stress and headaches in the months to come.