Posts by admin

Launch Strong with Start Up Business Equipment Leasing

When beginning a business, there are many things you must consider. The largest consideration is funding. Here is how you can launch strong with start up business equipment leasing. Starting a new business venture on your own can be nerve-racking. There are a million things to juggle, and half a million plates to keep spinning.…

READ MORE >>The Many Benefits of Leasing Restaurant Equipment

Leasing restaurant equipment is a great way to preserve cash flow, build capital, and grow your business. Here are the many benefits of leasing such equipment. The costs of running a business are immense. The costs of running a restaurant, however, are often even greater than the average business. Restaurants must worry about significant labor…

READ MORE >>How Commercial Financing Benefits Your Business and Your Customers

Commercial financing options are ideal for when you need an influx of capital without endangering your cash flow or seeking traditional lending options. Commercial financing only differentiates itself from other kinds of financing in that business-specific loans may be easier to apply for and offer lower overall interest rates than personal or traditional loans. If…

READ MORE >>3 Important Tax Benefits of Leasing Equipment (And What They Mean for Your Business)

To buy or to lease? That’s the question. When acquiring new equipment, it’s important to weigh your options carefully and decide what’s best for the business – but in most cases, the answer is far from straightforward. In addition to weighty pros and cons, ranging from a heftier upfront deposit to a bigger long-term bill for…

READ MORE >>How Medical Practice Loans Can Help You Grow Your Practice

Whether you are just starting a medical practice, or have one already established, medical practice loans can help your business grow and thrive. Setting up a private practice, urgent care clinic, or primary care facility does not come cheap. A physician making the leap to managing a practice of their own will be faced with overwhelming…

READ MORE >>5 Types of Commercial Equipment Loans to Expand Your Business

Commercial equipment loans are a valuable way to expand business in an efficient manner, but what type of loans are best for you? The majority of businesses utilize commercial equipment loans to: Reduce upfront costs Preserve their cash flow Make better use of their working capital Benefit from the tax advantages of writing off the…

READ MORE >>How to Get Business Equipment Loans: Your Step-By-Step Guide

Starting a business requires a substantial investment. Business equipment loans can help offset the risk of acquiring new equipment. Getting a business up off the ground is no small feat and involves much more than just securing initial funding. You will need to invest your revenue, cut your losses, cover your costs, all while retaining…

READ MORE >>Computer Financing: The Best Options to Set Up Your Business for Success

Due to shortages, computers have become increasingly more expensive. Computer financing has the potential to save your company a significant amount of money. Equipment leasing and financing options are the way to go for most businesses looking to outfit themselves with pricy heavy-duty equipment, move to a new location, or acquire commercial real estate. But…

READ MORE >>What To Look for In Equipment Leasing Companies

Equipment leasing has the potential to save you a large amount of money. Here are some things you might want to consider when looking for equipment leasing companies. Lean growth is the name of the game. Managing your costs effectively and reinvesting your profits wisely is important to survive against today’s stiff competition, regardless of…

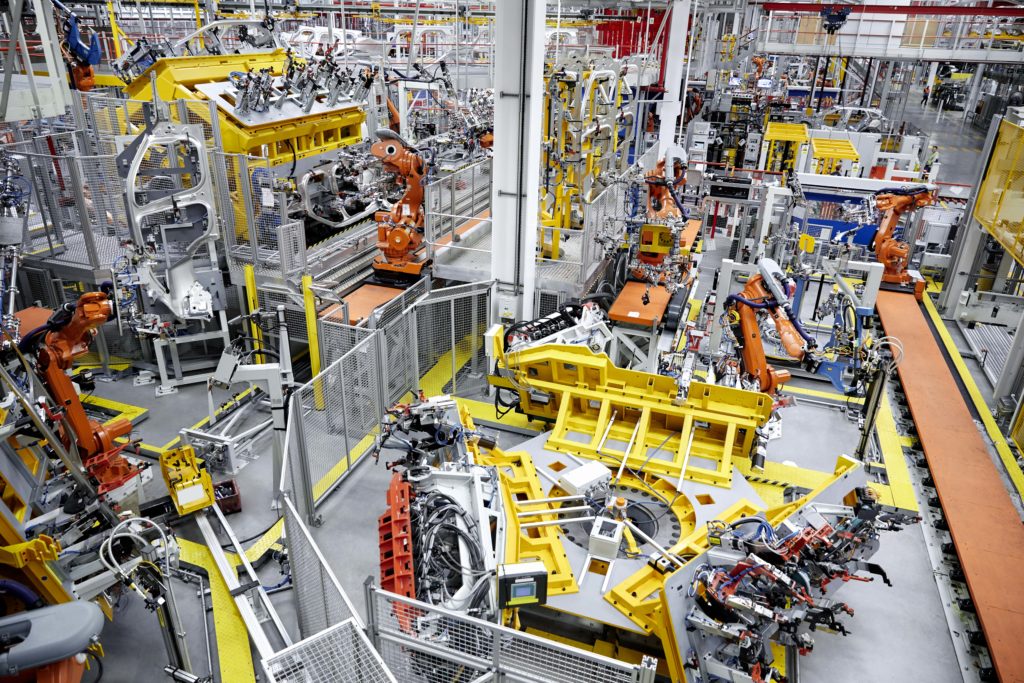

READ MORE >>Factory Equipment: The Basics of Leasing and Financing

Factory equipment is an essential aspect of business, but what is the best way of financing and receiving new equipment? Here’s what you should know about leasing and financing options. Whether you run a small business or manage acquisitions for a larger company, having heavy equipment break down can put a massive dent in your…

READ MORE >>